Executive Summary

Institutional investors are racing to gain crypto exposure after witnessing the extraordinary returns of Bitcoin over the last decade. However, as Bitcoin matures as an asset, its volatility, and therefore its return potential, is steadily declining. To replicate these past returns, many allocators are now turning to the broader crypto market, often assuming that the same buy-and-hold approach that worked for Bitcoin can deliver similar results.

Historical data reveals a different reality: buy-and-hold strategies consistently fail when applied to the broader crypto market. Most altcoins suffer catastrophic drawdowns from which they never recover. What the broader crypto market does offer, however, is unprecedented volatility and persistent inefficiencies. These conditions are poorly suited to buy-and-hold investing but well suited to systematic trading strategies designed to capture short-term dislocations.

Robuxio provides institutional-grade access to this opportunity through robust, risk-managed exposure to the broader crypto market. Our proprietary platform executes over twenty uncorrelated momentum and mean-reversion strategies across the top 50 crypto futures, designed to generate returns in both bull and bear market conditions while avoiding the permanent capital losses common in buy-and-hold portfolios.

These strategies operate through our fault-tolerant trading engine, which eliminates human error, enforces disciplined signal-based execution, and scales securely across thousands of portfolios with real-time monitoring and institutional-grade infrastructure. Combined with strict risk controls and diversification, this approach enables institutions, family offices, and sophisticated investors to access crypto's upside potential while significantly reducing downside exposure.

The Problem

Bitcoin's Diminishing Returns

Many financial institutions are racing to gain crypto exposure after witnessing Bitcoin's outsized returns over the past decade. However, Bitcoin's volatility is declining (a typical sign of asset-class maturation) and its future returns are likely to diminish, following patterns observed in other emerging markets.

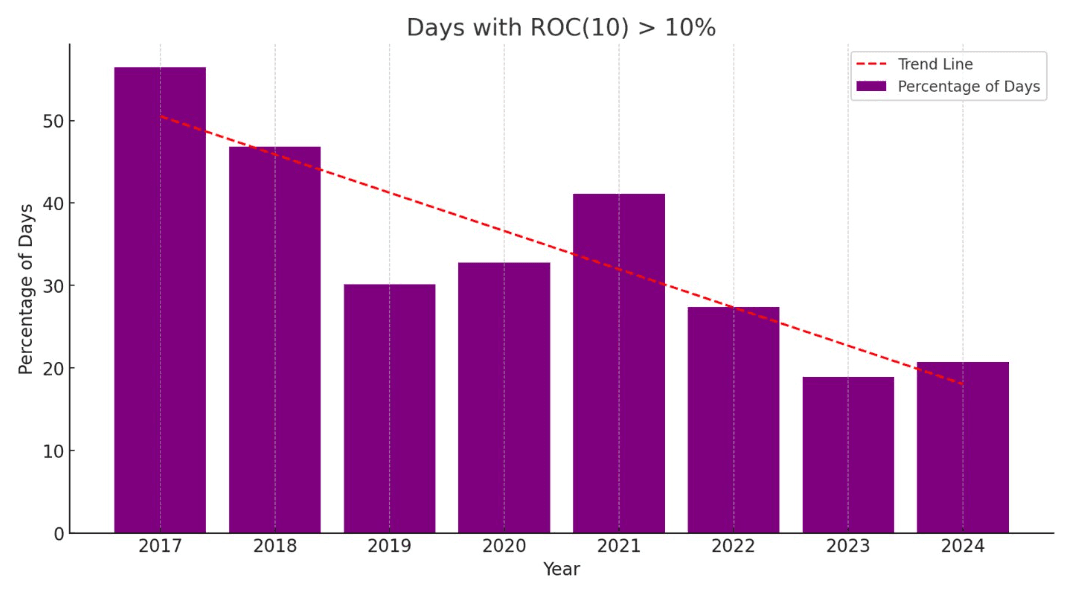

As shown in Figure 1, the percentage of 10-day periods each year with returns above 10% has fallen sharply from 2017 to 2024. In 2017, 69.3% of 10-day periods delivered positive returns of 10% or more, compared to only 22.2% in 2024. This declining volatility suggests that Bitcoin's extraordinary early-stage returns are unlikely to be repeated at the same magnitude.

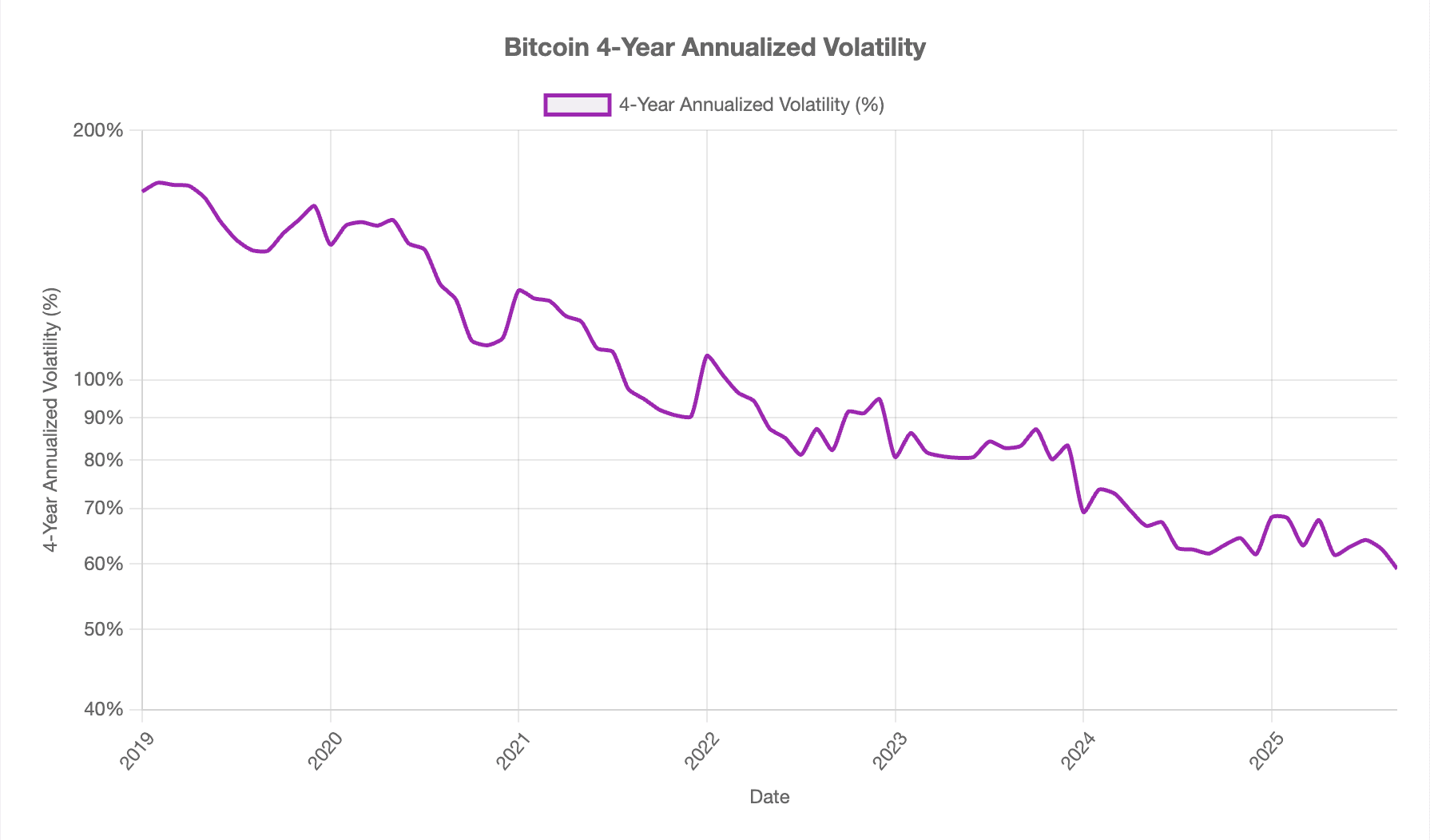

This trend is further confirmed by Bitcoin's steadily declining 4-year annualized volatility, which has fallen from over 180% in early 2019 to approximately 60% by late 2025. As volatility compresses, the magnitude of potential returns naturally diminishes, signaling Bitcoin's evolution from a high-growth speculative asset to a more mature digital store of value.

The Buy-and-Hold Trap

In search of similar outsized gains, many investors have turned to the broader crypto market. Yet most approach it incorrectly. While buy-and-hold strategies may be acceptable for Bitcoin (despite severe drawdowns), they fail almost entirely when applied to the broader crypto universe.

Consider this stark example: if you had purchased the 20 largest cryptocurrencies at the market peak in late 2021, only three would have recovered to positive returns by July 2025. The majority suffered deep drawdowns exceeding 70%, with many coins losing over 90% of their value.

Table 1: Performance of Buy and Hold on Top 20 Coins in 2021 (returns from 1/11/2021 – 1/7/2025)

| Coin | Return | Coin | Return |

|---|---|---|---|

| XRP | 98.54% | BTC | 74.28% |

| BNB | 25.22% | XLM | -36.14% |

| DOGE | -35.53% | SOL | -23.44% |

| LINK | -58.39% | ETH | -43.40% |

| ADA | -72.21% | ETC | -67.76% |

| SHIB | -83.40% | FTM | -87.98% |

| AVAX | -72.05% | VET | -84.41% |

| ATOM | -88.75% | MATIC | -90.41% |

| ALGO | -89.82% | DOT | -92.04% |

| XTZ | -91.41% | LUNC | -100.00% |

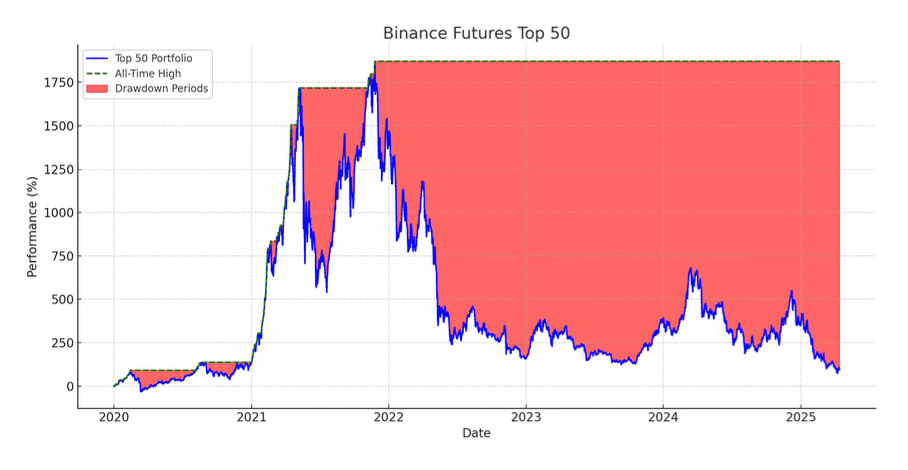

The results are even worse when examining the Top 50 Binance Futures Index, a daily-rebalanced, equally weighted basket of the top 50 crypto futures available on the world's largest crypto exchange. As illustrated in Figure 3, most cryptocurrencies never recover from major drawdowns and eventually trend toward zero.

Buy-and-hold strategies may work for Bitcoin, but they are consistently capital destructive in the broader crypto market. Identifying future winners is extremely difficult, and the cost of being wrong is severe, often resulting in permanent capital loss.

While Bitcoin's returns gradually diminish, the broader crypto market continues to exhibit high volatility and inefficiencies, which open the door for a fundamentally different approach.

The Opportunity

While buy-and-hold strategies have proven ineffective for the broader crypto market, the same characteristics that make them unsuitable for passive investing—extreme volatility, persistent market inefficiencies, and emotionally driven participants—make them highly attractive for systematic trading.

Volatility Is Opportunity

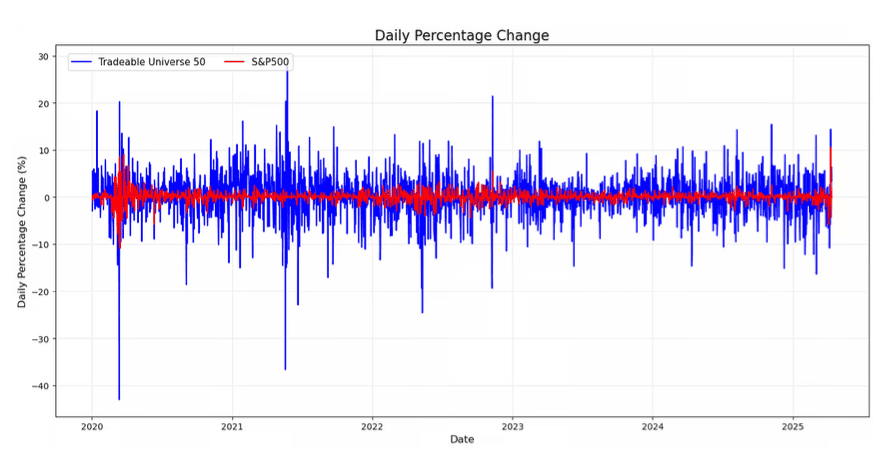

Crypto remains one of the most volatile and inefficient asset classes globally. Daily price movements of the top 50 Binance-listed futures contracts are often 5–10 times larger than those of major equity indices such as the S&P 500. This elevated volatility creates frequent price dislocations and short-term momentum patterns that quantitative strategies can systematically exploit.

For traditional investors, volatility represents risk. For systematic traders, volatility represents opportunity. Larger price swings generate more frequent and more profitable trading signals, while the crypto market's structural inefficiencies persist far longer than in mature markets.

Ranking by Relative Momentum

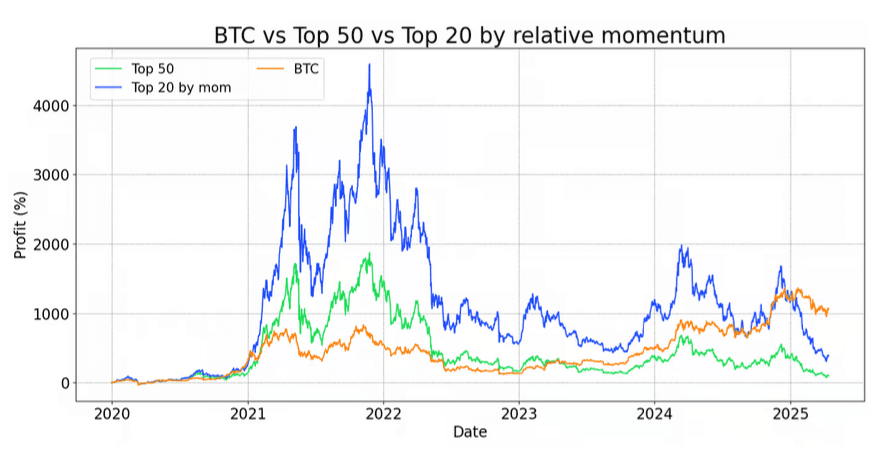

An important factor beyond overall volatility is the magnitude of relative performance during market trends. During major market moves, smaller crypto assets tend to significantly outperform larger ones, and ranking assets by relative momentum amplifies this effect even further, as shown in our momentum-ranked performance data in Figure 5.

This combination of high volatility, structural inefficiencies, and behavioral mispricings creates a rare and time-sensitive window for systematic strategies to capture outsized risk-adjusted returns before crypto markets mature further and these inefficiencies diminish.

Our Approach

Our goal is to provide unbiased, market-regime-agnostic exposure to cryptocurrency markets, designed to perform across both bull and bear market conditions. Rather than relying on any single approach, we operate a diversified portfolio of over 20 uncorrelated strategies built on two of the most consistently proven edges in crypto trading.

Momentum (long & short)

Captures upside breakouts and hedges against downward trends. Exploits the strong momentum effect observed in crypto markets.

Mean reversion (long & short)

The most stable edge in crypto, which profits from short-term overreactions and provides stability during non-trending market conditions.

Strategy Development and Validation

Given the limited historical data available for crypto futures, each strategy is grounded in decades of validated out of sample performance from traditional finance, adapted specifically for cryptocurrency market dynamics and continuously monitored under live trading conditions.

We maintain benchmark models for each targeted market behavior to validate that live strategy performance aligns with expected outcomes. When live results diverge materially from expectations, we investigate whether the model is accurately capturing the intended market behavior and make appropriate adjustments.

Dynamic Universe Selection

To eliminate selection bias and ensure robust results, all strategies operate on a dynamic universe of the top 50 USDT-settled crypto futures. This universe is reconstituted daily based on volume and liquidity thresholds, ensuring:

- Tradability: Only highly liquid instruments are eligible for positions

- Bias-free selection: No hindsight or selection bias in universe construction

- Market representation: Captures the most actively traded crypto assets

- Adaptability: Universe evolves with changing market structure

The Trading Engine

At the core of Robuxio is a proprietary, fault-tolerant trading engine that executes more than twenty uncorrelated, rule-based strategies across a dynamic universe of highly liquid USDT-settled crypto futures. The engine replaces manual fragility with robust execution and scales to thousands of independent client portfolios without compromising discipline or performance.

Architecture and Execution

The engine ingests continuous market data streams. Strategy models evaluate recent and historical context to generate entry and exit instructions. These instructions are broadcast to independent, portfolio-level trading agents. Each agent adapts sizing and constraints to the portfolio's bankroll and policy, ensuring consistent logic with portfolio-specific execution.

Execution is liquidity-aware. Orders are sliced, paced, and offset as needed to reduce footprint, preserve fill quality, and remain robust during periods of elevated volatility. Agents run in parallel, allowing thousands of portfolios to operate concurrently under common global rules while remaining isolated from one another.

Only assets that meet predefined liquidity are eligible for long or short positions. The tradable universe is reconstituted daily from the currently liquid USDT-settled futures, ensuring eligibility reflects live market liquidity and remains bias free.

Operational Safeguards

A pre-trade risk router validates every instruction before any order is sent. Checks include exposure limits, collateral rules, instrument allow-lists, and venue health. A 24/7 live monitoring layer supervises orders, fills, connections, and data coherence. It detects and corrects anomalies, such as failed settlements, API disruptions, or state mismatches, and maintains alignment through automatic reconciliation and autosync.

Performance & Latency

Core processes run on a high-throughput, low-latency stack and are deployed in close proximity to primary exchange infrastructure. This reduces instruction-to-execution delay and preserves reliability during extreme market conditions.

Security & Isolation

The trading engine runs entirely within a private network, with no public access. Sensitive systems, internal tools, and execution pathways are not exposed to the public internet. Portfolio state and execution records reside behind strict traffic management and access controls designed for low-latency reads/writes under load, ensuring the database remains responsive even at scale.

The Portfolios

Our flagship offering is our High Sharpe Portfolio, a short-term focused portfolio that combines momentum breakout and mean reversion strategies on both the long and short side.

This portfolio is specifically designed to capture short-term profits, even in sideways or non-trending markets. To reduce volatility, it deliberately excludes longer-term momentum strategies.

Volatility Profiles and Customization

The High Sharpe Portfolio is available in two standardized volatility profiles:

- High Volatility Profile: Targets higher returns with correspondingly higher volatility for aggressive allocators.

- Low Volatility Profile: Emphasizes capital preservation with more conservative risk parameters for risk-averse institutions.

Both profiles can be further customized to match specific institutional mandates.

Collateral Options

All portfolios trade USDT-settled futures contracts but offer three distinct collateral approaches:

USD Stablecoin Collateral

Provides pure strategy exposure without additional currency risk, ideal for institutions seeking isolated crypto trading alpha.

Bitcoin Collateral

For institutions wanting Bitcoin exposure plus trading alpha, with profits automatically converted to Bitcoin weekly. These portfolios typically emphasize short breakout strategies to hedge against Bitcoin-specific downside risks.

Ethereum Collateral

Similar to Bitcoin collateral but denominated in Ethereum, suitable for institutions with existing Ethereum allocations seeking enhanced returns through systematic trading.

The historical returns of the portfolios are shown in Table 2 below. Detailed portfolio factsheets can be found by clicking on the specific portfolios in the table.

| Portfolio | CAGR | Daily Volatility | Max Drawdown | Sharpe Ratio |

|---|---|---|---|---|

| High Sharpe High Vol - USD | 191.63% | 2.19% | -30.40% | 3.58 |

| High Sharpe Low Vol - USD | 71.52% | 1.08% | -17.21% | 3.69 |

| Benchmarks | ||||

| Bitcoin | 63.83% | 3.32% | -76.67% | 1.10 |

| Binance Futures Top 50 Index | 17.17% | 4.80% | -91.25% | 0.65 |

Table: Historical Performance Metrics of Robuxio Portfolios. Portfolio name colors indicate collateral type: Green (USD), Orange (Bitcoin Benchmark), Purple (Index Benchmark). All portfolio returns are NAV (01/01/2020 – present).Data refreshed: February 2, 2026

Risk Management

Risk management forms the foundation of our systematic approach, built to protect capital from both market-wide drawdowns and idiosyncratic cryptocurrency failures (the two largest tail risks in crypto exposure).

Market-Wide Risk Mitigation

- Directional Diversification: Market-wide drawdowns are addressed through combined long and short exposure across our broad strategy set. Our portfolios include over 20 uncorrelated trading approaches designed to generate returns in both bullish and bearish market regimes, limiting directional exposure to any single market trend.

- Strategy Correlation Management: All strategies are selected based on rigorous correlation analysis during development, with ongoing systematic monitoring. Returns are improved and drawdown periods reduced by trading a large set of uncorrelated strategies.

- Regime Detection: We incorporate regime change detection to identify when market conditions shift significantly, allowing strategies to only take new positions in favorable market conditions.

Single-Asset Risk Controls

- Position Sizing: Each individual trade represents only a small fraction of total portfolio capital, ensuring that no single position can cause significant portfolio damage.

- Diversification Requirements: Our dynamic universe approach ensures exposure remains spread across many liquid assets, reducing concentration risk and the impact of any isolated asset failure.

- Catastrophic Loss Protection: Black-swan stop-loss mechanisms protect against extreme adverse moves, protocol exploits, exchange delistings, or liquidity collapses.

Implementation Options

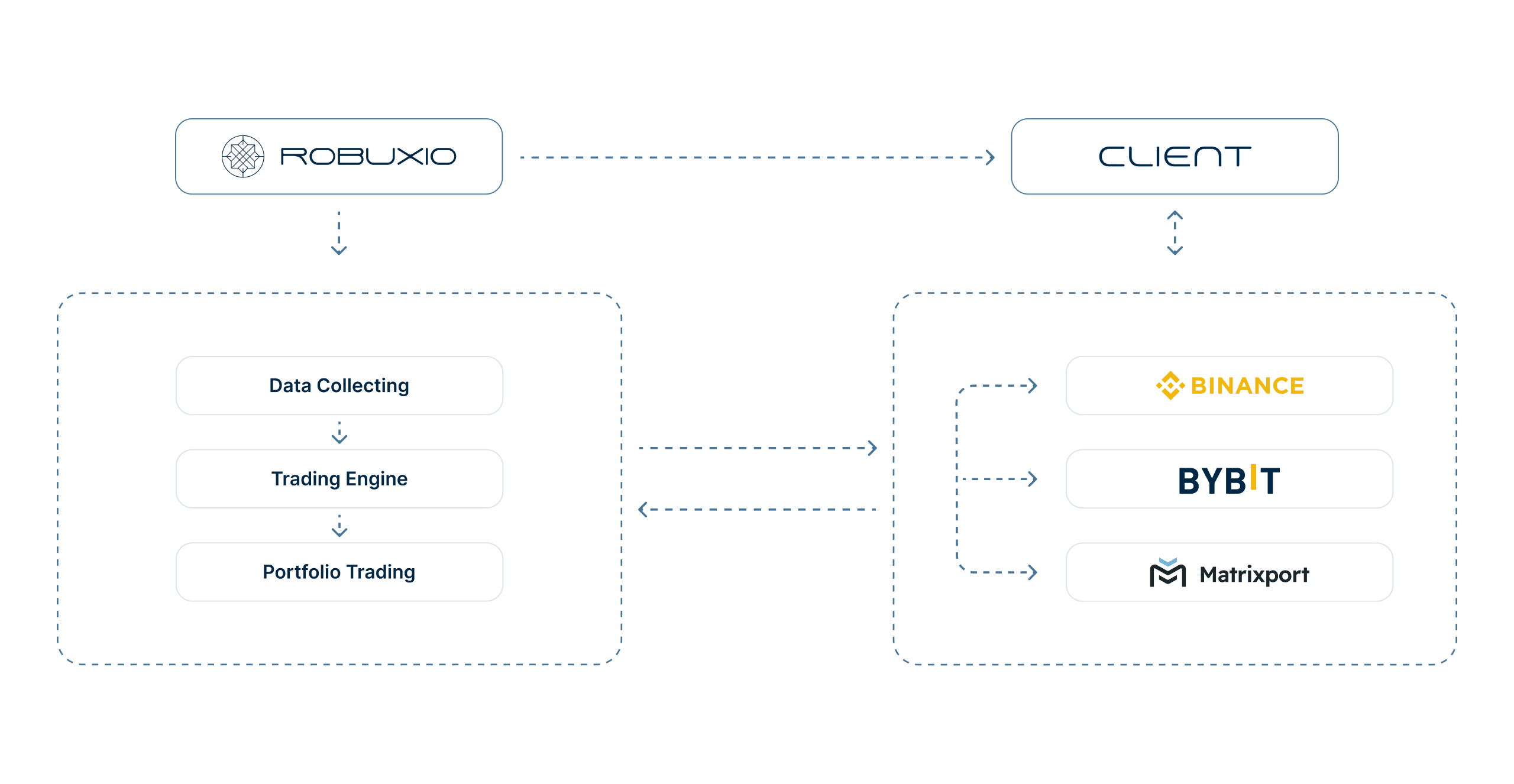

Robuxio provides multiple implementation pathways to accommodate different jurisdictions, operational preferences, and business models, ensuring institutional clients and HNWIs can access our systematic trading capabilities through their preferred structure.

Flexible Portfolio Access

- Direct Exchange Connection: Clients can connect their existing Binance or Bybit futures accounts directly to the Robuxio trading engine via secure, trade-only API keys. This approach allows clients to retain full custody of funds while enabling automated execution.

- Prime Brokerage Integration: For clients unable to access major crypto exchanges due to regional restrictions or institutional policies, we offer portfolio access through Matrixport, one of Asia's largest institutional crypto prime brokers headquartered in Singapore.

White-Label Solutions

In addition to direct portfolio access, institutions can also white-label the Robuxio trading engine and offer our strategies under their own brand. This option enables banks, brokers, and wealth managers to extend systematic crypto trading to their end clients without building the infrastructure in-house.

For Banks and Wealth Managers

Extend systematic crypto trading to end clients without building infrastructure, with new revenue streams, robust risk controls, and a competitive edge.

For Asset Managers

Launch crypto hedge funds or systematic trading products rapidly, while focusing on client acquisition and leveraging proven trading infrastructure.

Founders & Executive Team

Pavel Kýček (CEO & Co-Founder)

Pavel brings 18 years of trading experience and a strong background in risk management, having worked extensively in currency hedging for some of the biggest companies in his country. Now fully dedicated to Robuxio, he specializes in building uncorrelated strategies.

Xavier Fariña (CTO & Co-Founder)

A mathematician with advanced degrees in Big Data and Artificial Intelligence, Xavier combines 25 years of IT expertise with a forward-thinking approach to innovation. As a former Software Architect at HP, he excelled in designing complex systems. Now, he masterminds Robuxio's infrastructure and leads a talented development team.

Dries Van den Broecke (COO & Co-Founder)

As a former Olympic athlete, Dries applies the same resilience and determination from his athletic career to his role at Robuxio. He oversees most operations, connecting all parts of the company to foster a cohesive and innovative environment. His strategic mindset and entrepreneurial spirit drive Robuxio's growth and operational excellence.

Chris Jack (CGO)

As the former lead of Cambridge University's Digital Assets Program, one of the largest global public-private research initiatives, Chris brings deep expertise in digital assets and strategic growth. At Robuxio, he drives all facets of growth, from business development and partnerships to brand strategy, communications, and digital presence, shaping the company's public face and expanding its global reach.