Here’s the truth:

How does crypto compare to traditional markets?

At Robuxio, we categorize our trading into two main groups: Momentum and Mean Reversion, both on the long and short side.

But just looking at the momentum chart, it’s clear—most of the money is made by riding momentum to the upside.

So how do we capture it?

We don’t just use one strategy. Instead, we run a basket of strategies that take different approaches to catching upward momentum:

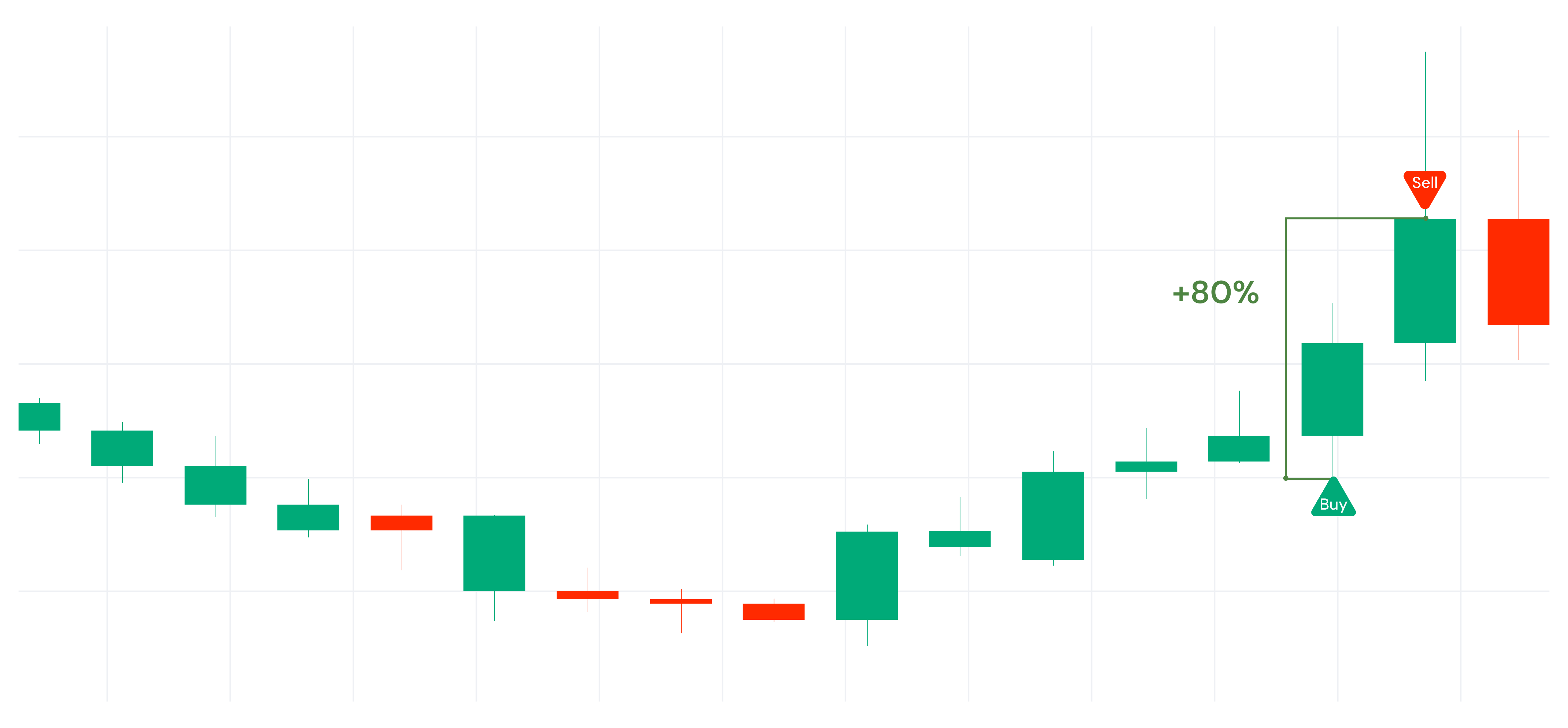

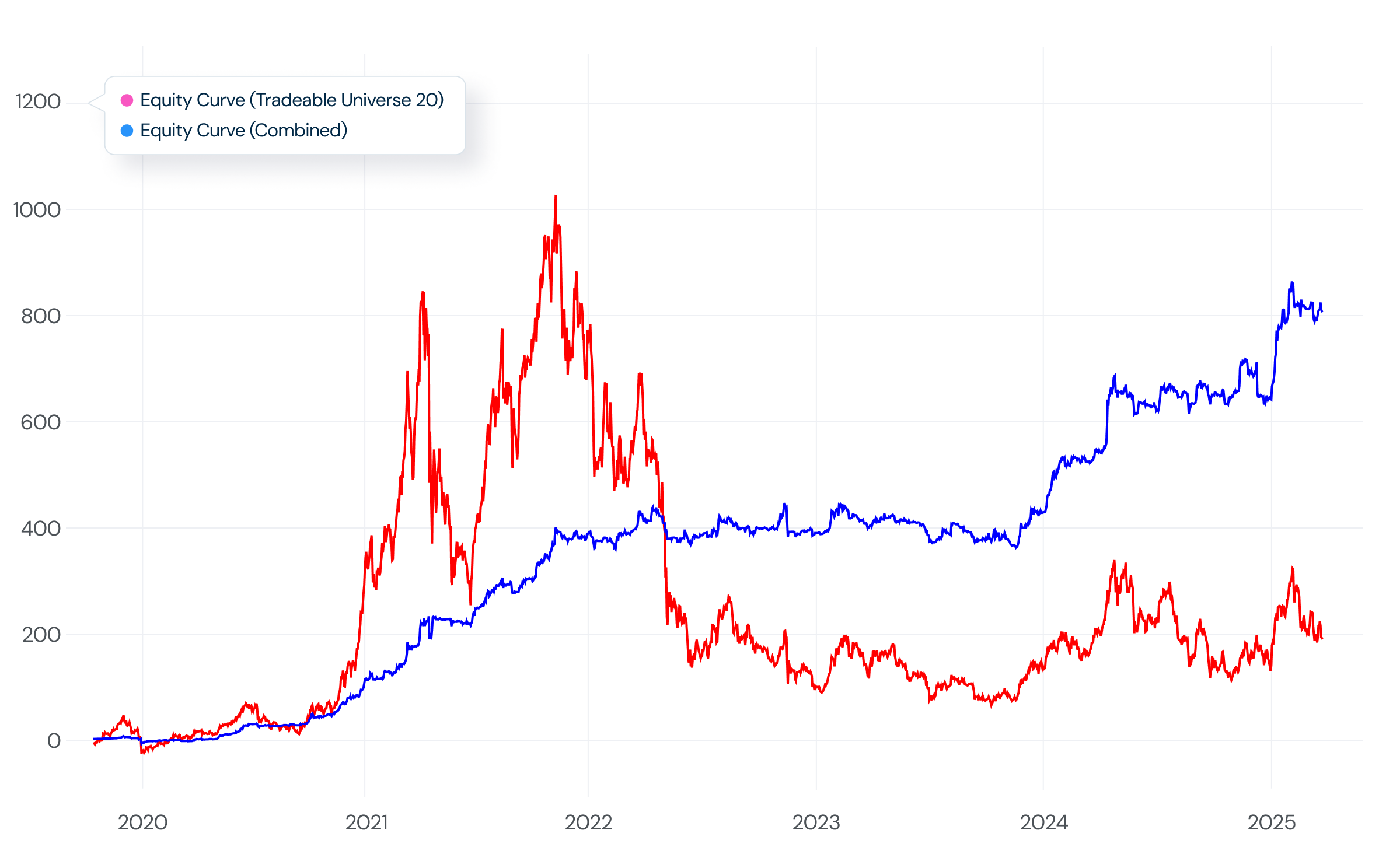

Look at the chart. It’s not random. It’s not magic.

We simply take the momentum—the beta—the good movement from crypto and avoid the downside. Simple as that. If you understand the market, it’s not complicated.

This is a an idea-first approach. Each strategy is built around a core market behavior. No overfitting, no random mix of indicators. Just pure momentum trading.

But here’s the crucial part:

With a momentum long strategy, you can only make money when the market goes up.

Trends are rare—only around 5% of the time is the market making new highs. The rest of the time, you’re in a drawdown.

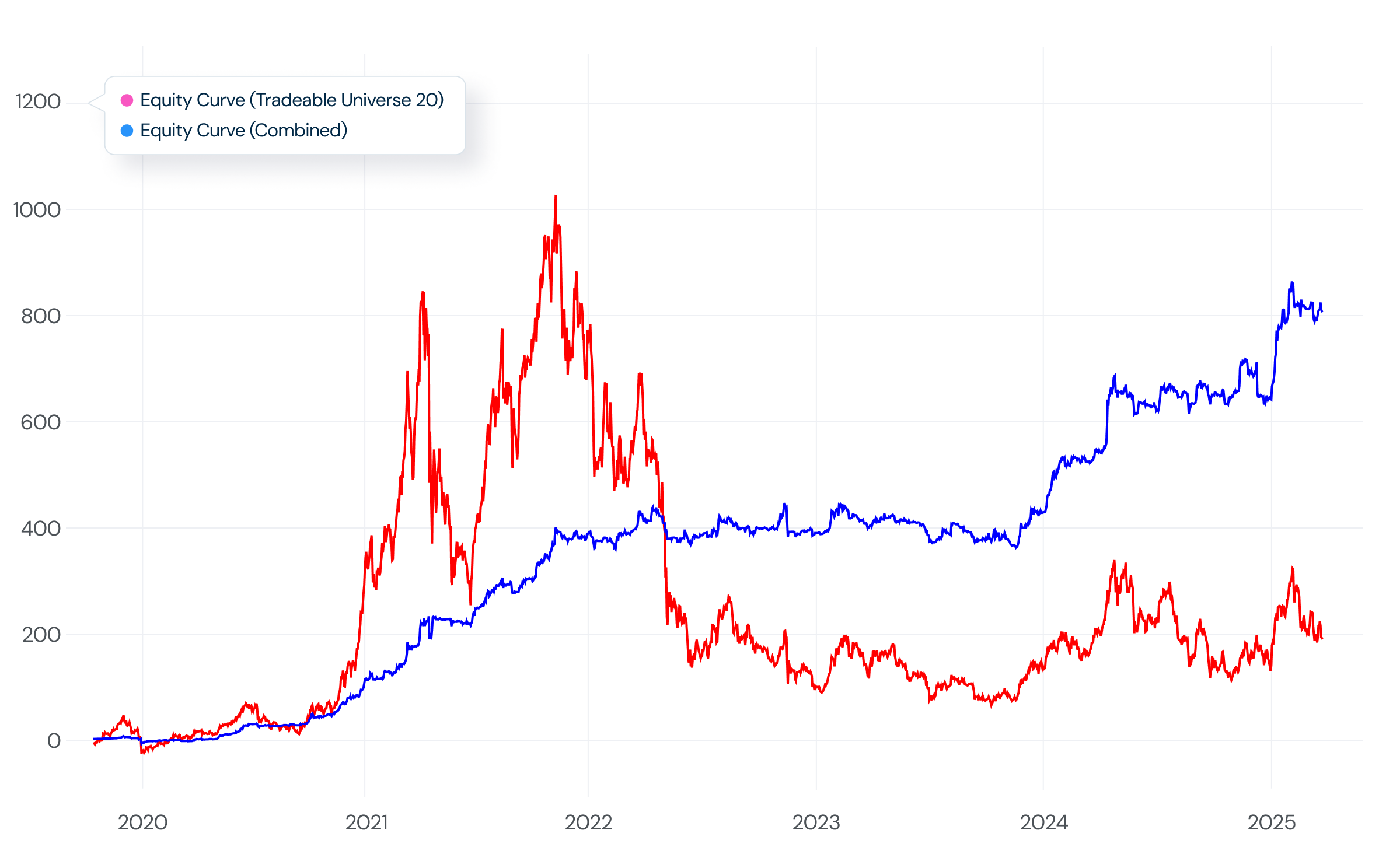

Let’s take a closer look at a zoomed-in chart of this sub-portfolio.

It’s simple—we profit when the market moves up, and we expect to lose when it doesn’t. That’s exactly how a momentum strategy should work.

Crypto doesn’t just go up. Should you have momentum short strategies?

Yes—if you want an all-weather portfolio. But shorting has its own challenges:

While these strategies aim to make money in downtrends, their primary role is risk management and portfolio hedging rather than being a core profit driver.

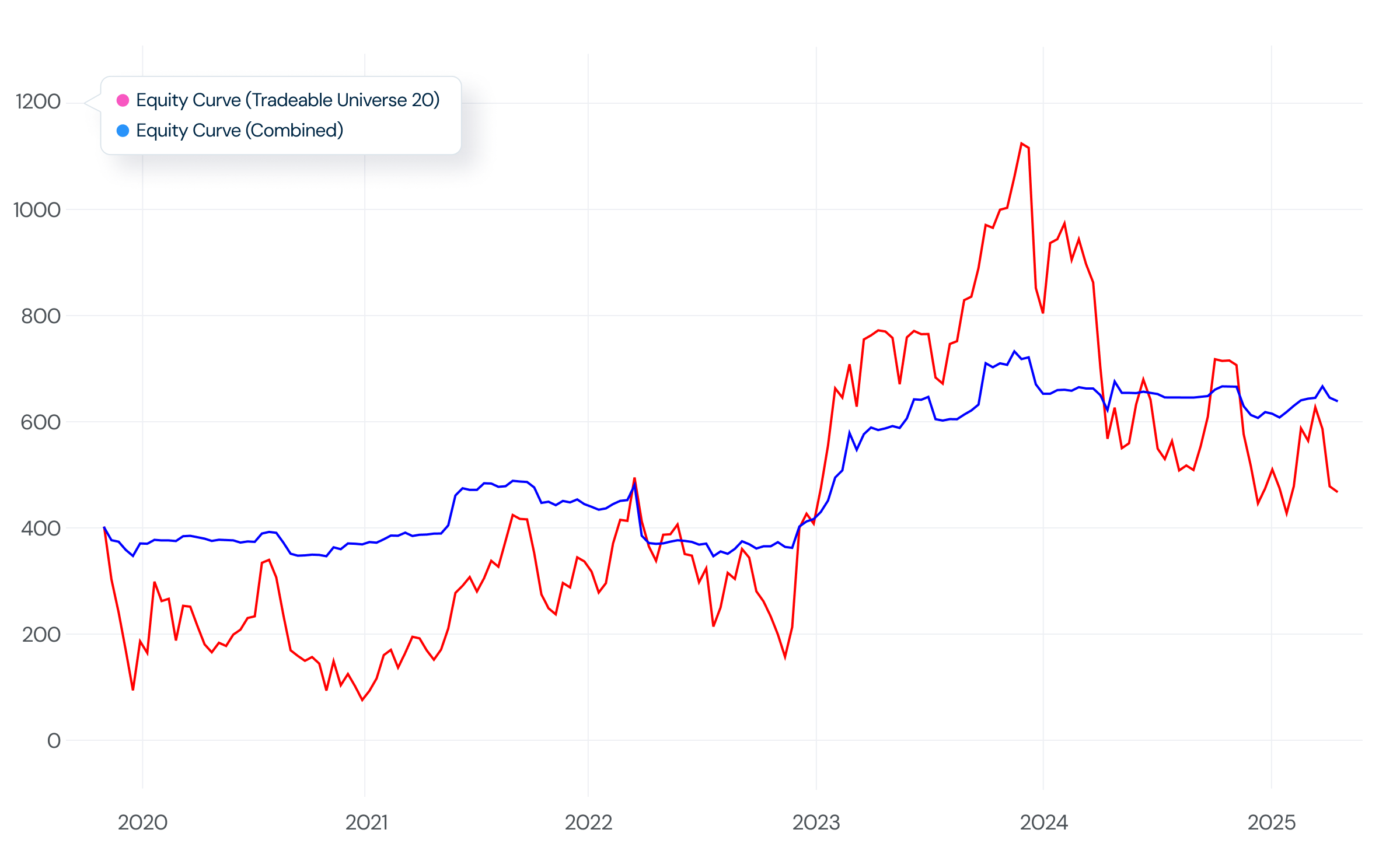

You might think, why not skip short strategies if they are barely profitable? Looking at the chart, you’ll see that they make money only when crypto is going down hard. But unlike long momentum strategies, they don’t generate nearly as much profit when the market moves in their favor. Most of the time, they lose money.

So why trade them at all? Because when combined in a portfolio, they improve overall performance. Let’s put them together in a portfolio trading on the same balance.

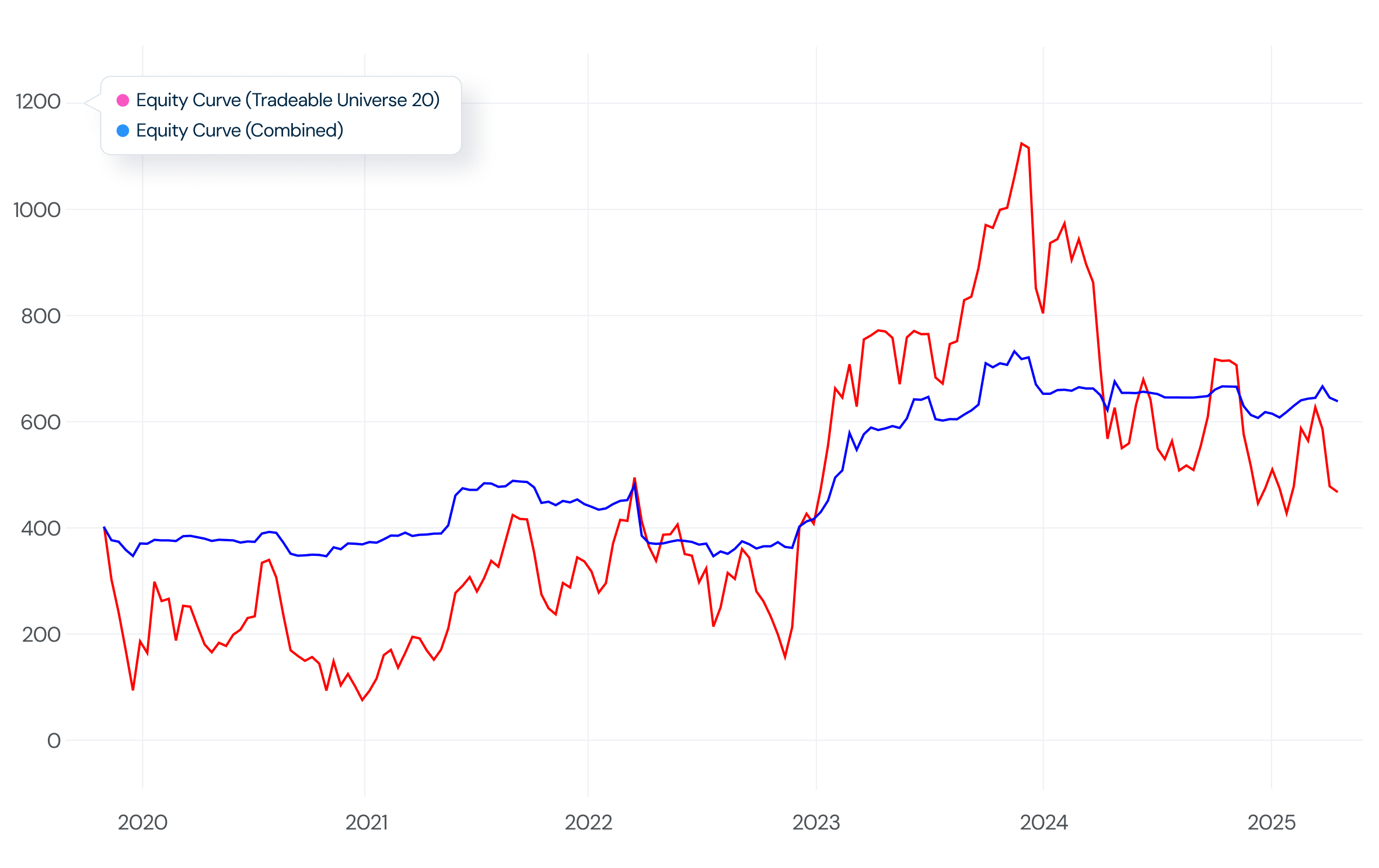

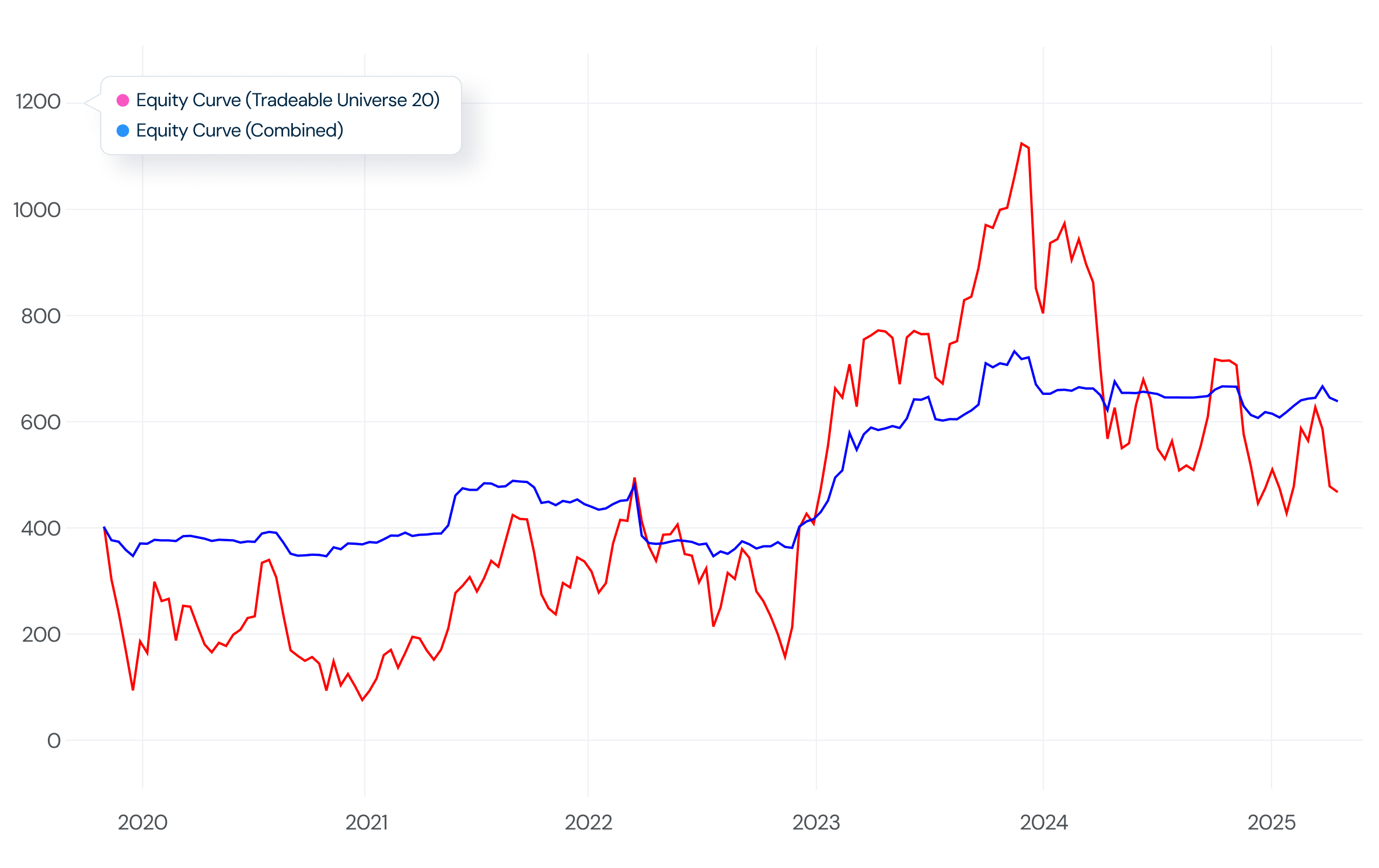

Now, take a look at the combined equity curve. It’s much more stable.

You can see how the “ugly” equity curve of the short portfolio actually improves the overall performance.

At first glance, long-only seems more profitable. But think long-term.

The Trend portfolio has no 3X more returns thanks to the short portfolio that would make not good returns as a standalone portfolio but once it the portfolio it’s incredible powerful.

Read more about it here: Blog Portfolio

When longs are making money, shorts are losing. When longs are losing, shorts are making money. Because of this, we can run them on the same balance, allowing them to offset each other’s drawdowns and create a smoother equity curve.

But that is not all, we also trade mean reversion. To the long and short side? Basically 2 approaches, some strategies that really long or short very big overreactions, think it as a rubber band you pull, the harder you pull the harder it will snap back to the mean. But unfortunately the rubber band can also snap sometimes hehe but that is when our hedge strategies come in to place to cover those mean reversion strategies that are not snapping back.

And then we have also mr strategies that buy the dips in very strong trending environment. They trade more often, do very good when the market is trending but when the market is really shifting from environment those will lose money. Just a small heads up 🙂

So again here the short strategy as standalone would make 50% return over the whole period

But once in a portfolio it get’s again pushed to new highs.

Low Volatility, Steady Returns

What goes up fast can come down just as quickly. Without stability, the same volatility that creates opportunities can wipe out gains.

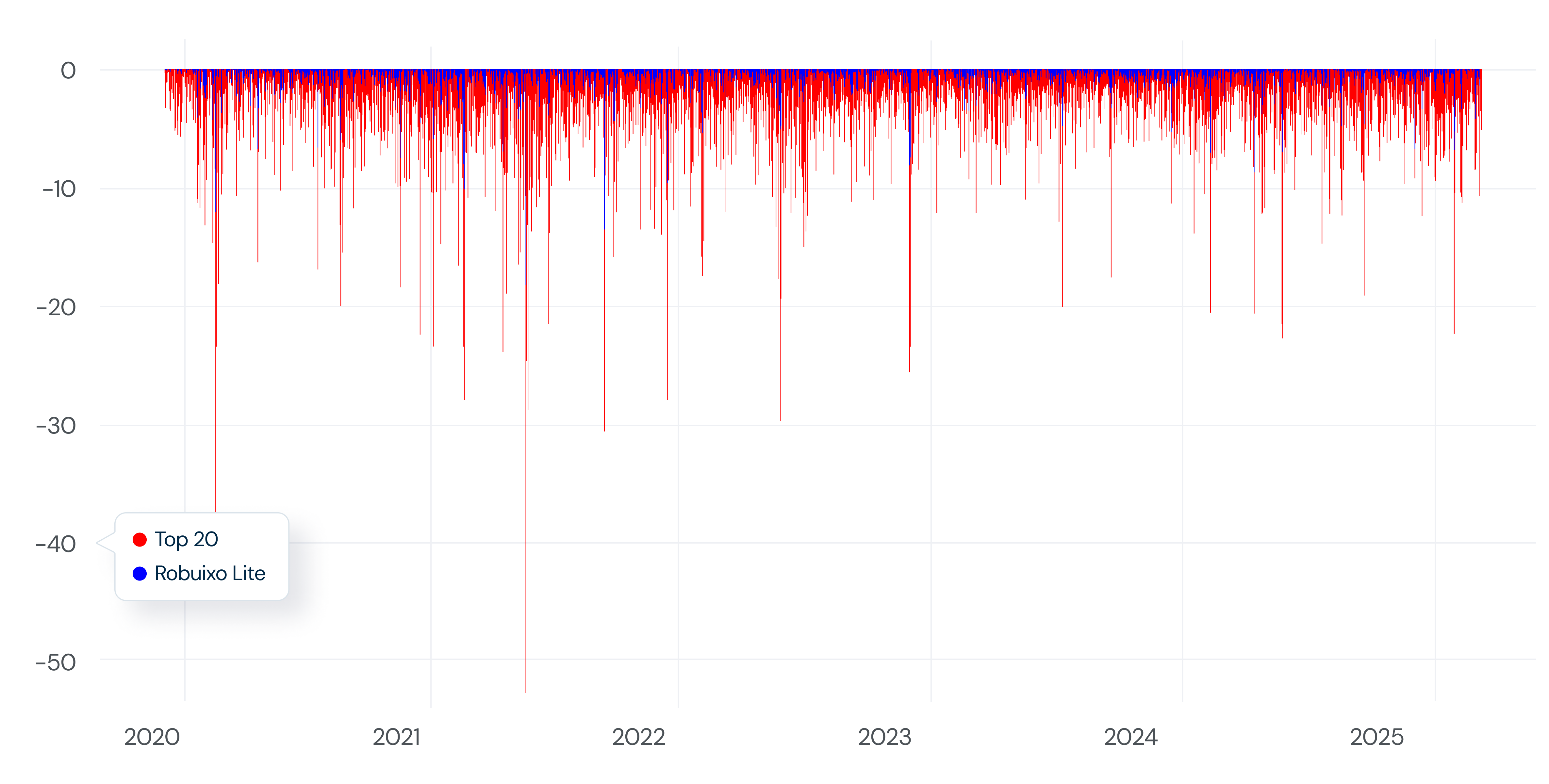

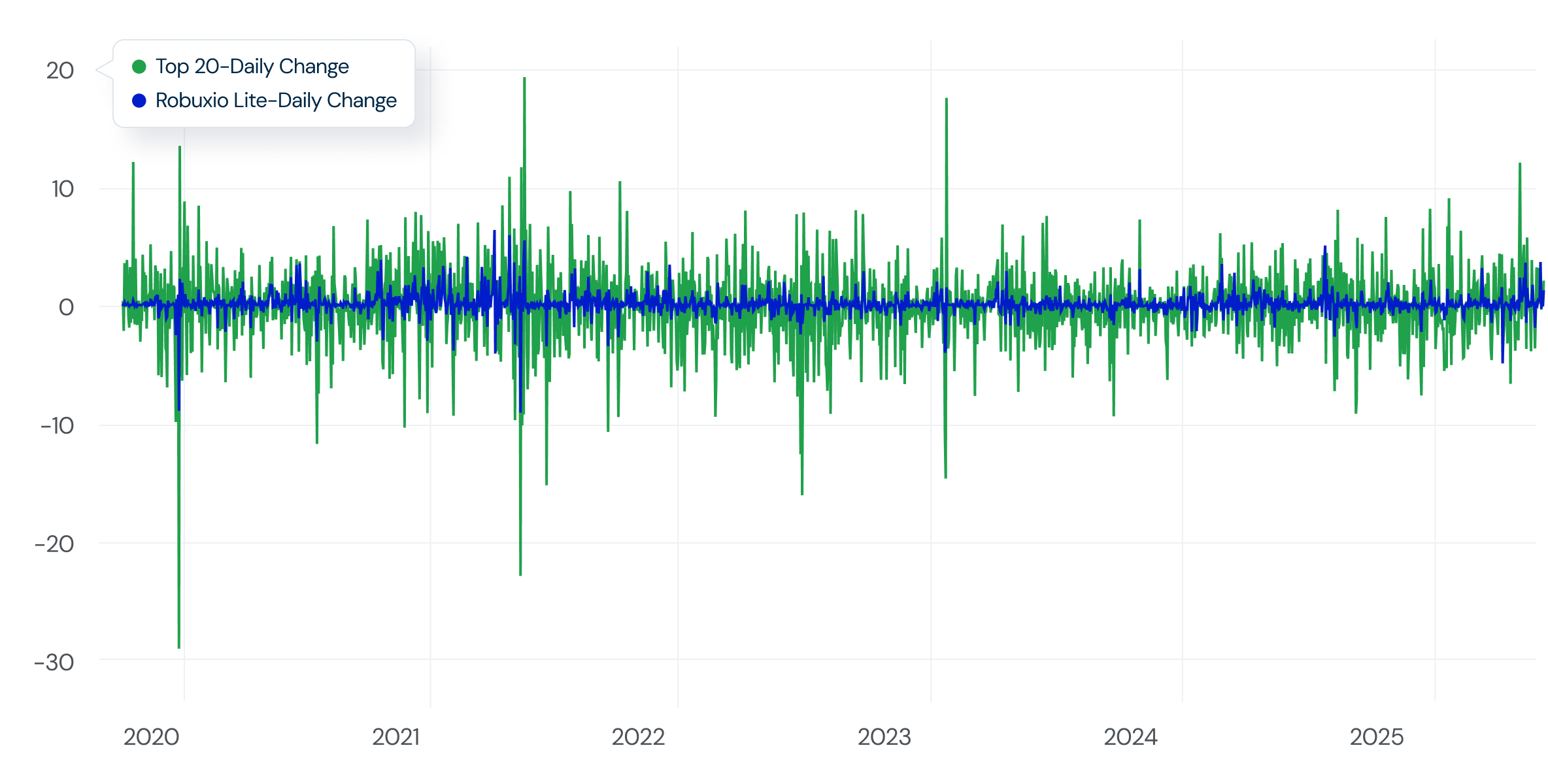

Robuxio flips the script: Look at the daily volatility of our High Sharpe Low Vol portfolio compared to the top 20 crypto index.

On average, the top 20 moves 5% from close to close, while Robuxio HSLV keeps daily moves to just 1%. But that’s not the whole story.

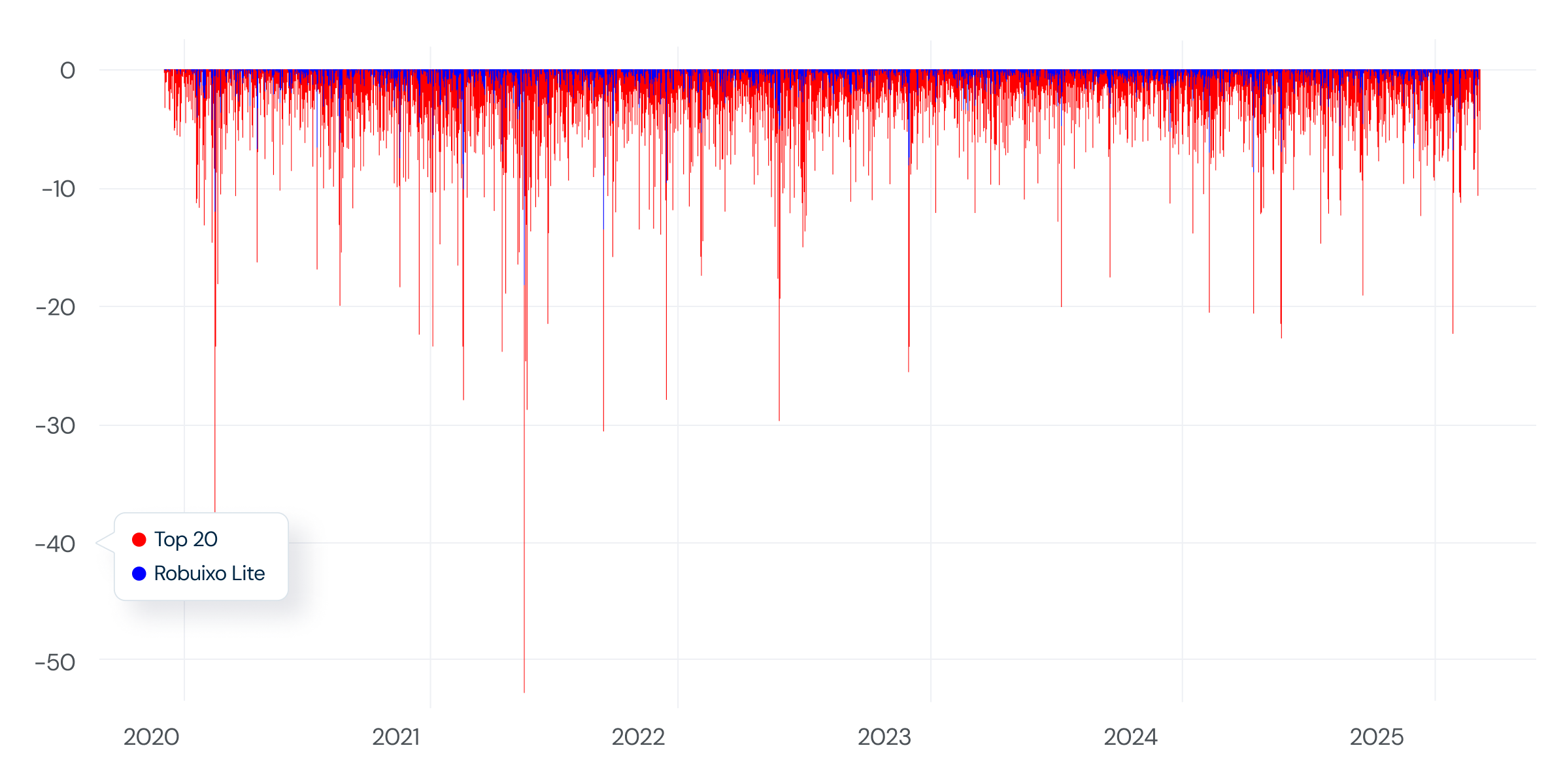

Take a look at the Maximum Adverse Excursion (MAE)—a measure of how far your balance moves against you compared to the open.

For the top 20 crypto index, trades often swing 30-50% against you during the day. In comparison, Robuxio HSLV’s MAE, based on historical data, has never exceeded 19%.

This isn’t luck—it reflects the effectiveness of our system in managing risk and protecting against excessive volatility. While the broader crypto market has historically averaged -4.77% daily adverse movement, Robuxio Lite has kept this to just -0.74%.

As you can see from the chart, Robuxio Lite smooths out the market’s extreme swings and stabilizes your portfolio. It’s aligned with the broader market during uptrends, generating profits, but stays flat or takes minimal losses during downtrends.

While it may not capture the extreme highs of the index, Robuxio Lite avoids the deep drawdowns that can take years to recover from. This allows for steady compounding over time—making it the smarter, more sustainable approach to crypto trading.

Most investors believe they can apply stock market logic to crypto—just buy and hold for the long term, like an index fund.

That doesn’t work.

The S&P 500 is designed to grow over time. It removes weak companies and keeps only the best performers. The index is a machine that naturally trends upward because it continuously updates with companies that bring the most value.

Crypto doesn’t work that way.

Most of the crypto assets don’t have built-in fundamental value. Unlike stocks, where companies generate revenue and profits, crypto is driven by speculation and momentum. If you had bought the “top 20 coins” from five years ago, most of them are deep underwater!

Low Volatility, Steady Returns

What goes up fast can come down just as quickly. Without stability, the same volatility that creates opportunities can wipe out gains.

Robuxio Lite flips the script: Look at the daily volatility of Robuxio Lite compared to the top 20 crypto index.

On average, the top 20 moves 5% from close to close, while Robuxio Lite keeps daily moves to just 1%. But that’s not the whole story.

Take a look at the Maximum Adverse Excursion (MAE)—a measure of how far your balance moves against you compared to the open.

For the top 20 crypto index, trades often swing 30-50% against you during the day. In comparison, Robuxio Lite’s MAE, based on historical data, has never exceeded 19%.

This isn’t luck—it reflects the effectiveness of our system in managing risk and protecting against excessive volatility. While the broader crypto market has historically averaged -4.77% daily adverse movement, Robuxio Lite has kept this to just -0.74%.

As you can see from the chart, Robuxio Lite smooths out the market’s extreme swings and stabilizes your portfolio. It’s aligned with the broader market during uptrends, generating profits, but stays flat or takes minimal losses during downtrends.

While it may not capture the extreme highs of the index, Robuxio Lite avoids the deep drawdowns that can take years to recover from. This allows for steady compounding over time—making it the smarter, more sustainable approach to crypto trading.

Whether you want exposure in USD, Ethereum, or Bitcoin, we have carefully designed portfolios to match your goals. Choose the one that suits you best.

Our Bitcoin-denominated portfolios use BTC as collateral, with additional hedges to protect against downside movements in BTC’s price. We currently offer both High Sharpe and Low Sharpe versions, each with different volatility and return profiles. If your priority is to grow your ETH stack, this could be a strong choice, despite higher USD volatility.

A combination of trend-heavy strategies (long-term trend following, shorter-term breakouts, etc.). Volatility is moderate, and while choppy markets can create some drag, trend-following remains robust over the long run. We cap exposure and strive to keep drawdowns within acceptable thresholds.

Focuses on short-term breakouts (up/down) plus mean reversion to smooth returns. While there is higher volatility, returns can be higher over the long run. Ideal for those who can tolerate larger daily swings in exchange for potentially higher gains.

Similar strategy mix, but with reduced net exposure, aiming for smoother equity curves. You might miss out on the highest return potential of the high-vol version, but you enjoy calmer daily swings and a shallower drawdown profile.

Purely mean reversion strategies, often trading against the trend. This is hedged to the downside with basic momentum shorts. We don’t recommend this for most users as a standalone. It could complement an existing long/short momentum portfolio.

Our Ethereum-denominated portfolios use ETH as collateral, with additional hedges to protect against downside movements in ETH’s price. We currently offer both High Sharpe and Low Sharpe versions, each with different volatility and return profiles. If your priority is to grow your ETH stack, this could be a strong choice, despite higher USD volatility.

Higher exposure to short-term breakout and mean reversion strategies, enabling more aggressive returns on your Ether. With higher risk comes higher volatility—ideal for ETH holders with a long-term conviction but wanting an active trading edge.

Similar strategy sets as High Sharpe, but toned down to reduce daily volatility. You’ll still retain an upside advantage if ETH trends upward, while the lower net exposure approach aims to soften potential drawdowns.

Our Bitcoin-denominated portfolios use BTC as collateral, with additional hedges to protect against downside movements in BTC’s price. We currently offer both High Sharpe and Low Sharpe versions, each with different volatility and return profiles. If your priority is to grow your ETH stack, this could be a strong choice, despite higher USD volatility.

An active approach leveraging short-term breakout and mean reversion strategies, with the potential for higher returns—and higher volatility—in BTC terms. Great for those with strong BTC conviction who aren’t put off by daily swings.

Uses similar strategy logic as High Sharpe, but dials back overall volatility. This is designed for BTC holders who prefer more stable returns over maximum growth potential.

Once you subscribe, you can choose one portfolio on a single exchange. Upgrade to Performance for unlimited access across all exchanges.

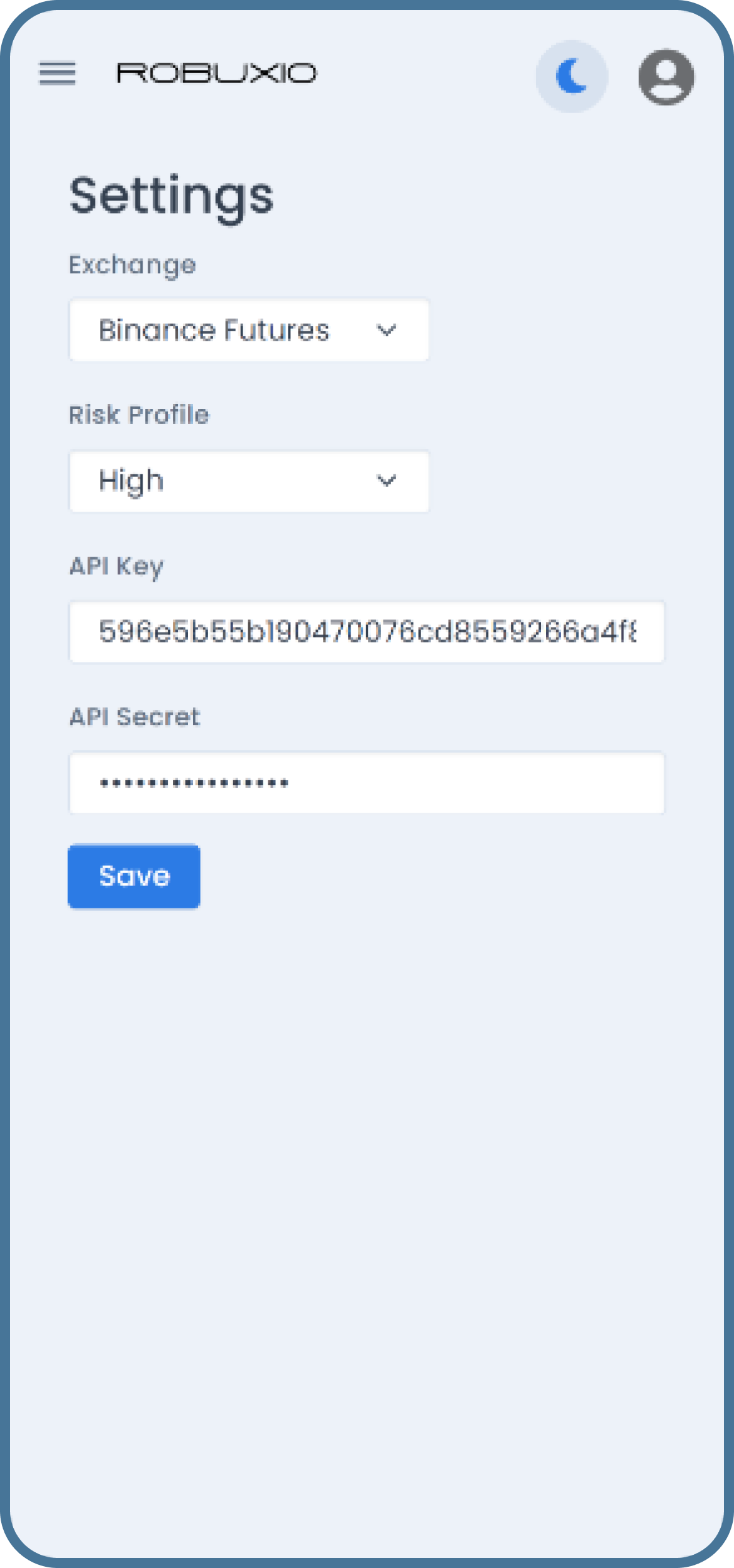

Data Collecting

Trading Engine

Portfolio Trading

We ensure clients are in sync with our system by continuously comparing our database with their current open orders and positions.

Any discrepancies are promptly addressed.

Robuxio executes trades on the clients account.

Data Collecting

Trading Engine

Portfolio Trading

We ensure clients are in sync with our system by continuously comparing our database with their current open orders and positions.

Any discrepancies are promptly addressed.

Robuxio executes trades on the clients account.

Data Collecting

Trading Engine

Portfolio Trading

Robuxio executes trades on the clients account.

At Robuxio, we pride ourselves on being more than just a one-person operation. Our platform is the result of a dedicated and diverse team of experts—a team as uncorrelated in their talents as our portfolio of strategies, creating a better end product than anyone could achieve alone who ensure that Robuxio delivers unmatched performance, reliability, and innovation in crypto trading. Here’s who makes it all happen:

Pavel brings 18 years of trading experience and a strong background in risk management, having worked extensively in currency hedging for some of the biggest companies in his country. Now fully dedicated to Robuxio, he specializes in building uncorrelated strategies.

As a former Olympic athlete, Dries applies the same resilience and determination from his athletic career to his role at Robuxio. He oversees most operations, connecting all parts of the company to foster a cohesive and innovative environment. His strategic mindset and entrepreneurial spirit drive Robuxio’s growth and operational excellence.

A mathematician with advanced degrees in Big Data and Artificial Intelligence, Xavier combines 25 years of IT expertise with a forward-thinking approach to innovation. As a former Software Architect at HP, he excelled in designing complex systems. Now, he masterminds Robuxio’s infrastructure and leads a talented development team.

Netherlands

Australia

Czech Republic

Robuxio’s free portfolio isn’t just a demo; it’s a fully automated trading system using real strategies focused on stability and consistent returns. It provides you with a solid introduction to our professional-grade approach, allowing you to experience live trading at no cost.

After signing up, you’ll have the option to select your exchange (KuCoin, Bybit, or OKX) and connect via API. Instructions are provided in your dashboard to guide you through the process securely.

Our system will use a hard cap of 5,000 USDT to calculate position sizes for trading. While you can have a higher balance, it won’t be taken into account when placing trades. This is part of our free portfolio service.

Yes, Robuxio provides a live performance chart for your portfolio within your dashboard. You’ll be able to monitor everything live.

If your balance falls below 1,000 USDT, you’ll receive a notification to top up your account. Trading will pause if the balance is too low to meet our minimum requirements for placing all trades.

You can manage your exchange connections on the Profile page. However, we don’t support API replacement for free accounts, as we don’t offer full support for managing and monitoring a complete swap. You can close all positions and submit new keys to start trading again. Once you lose API connection or delete keys, we have no access, so it will be your responsibility to close all positions.

Currently, you can select one exchange per account for trading. With our performance program, however, you can trade on all supported exchanges simultaneously with an aggregated dashboard for monitoring.

With Robuxio, we bring professional approaches to crypto trading that have been proven successful in traditional assets over decades of use.

Don’t miss out on Robuxio’s latest research and newsletters. Subscribe now!

We care about your data in our privacy policy.