Automated Crypto Portfolios

For Serious Investors

Connect to our API. Choose your portfolio. Let us handle the rest.

Four Simple Steps to Start

Robuxio isn't just a signal service or a bot. It's a fully automated infrastructure stack built to deliver institutional-grade execution, real-time monitoring, API routing, and portfolio management, without requiring you to build anything yourself.

We've engineered the complexity behind automated portfolio trading to make professional crypto exposure accessible to everyone.

Choose Your Access

Prime brokerage or direct exchange access

Setup Your Infrastructure

Securely connect to our institutional trading engine

Choose Your Portfolio

Based on volatility and collateral preferences

Enjoy The Ride

24/7 automated execution, real-time monitoring

Step 1: Choose Your Access

Two Ways to Access Institutional-Grade Trading

Prime Brokerage

Direct Exchange

Step 2: Infrastructure Setup

Secure Connection to Institutional-grade Trading Infrastructure

All trades are executed using trade-only API keys. Trading permissions are enabled but withdrawal rights are disabled, meaning we can place trades, but never move your capital.

Step 3: Choose Your Portfolio

Tailor Your Exposure to Fit Your Preferences

Select portfolios based on your volatility and collateral preferences. Every portfolio is powered by a blend of up to 20 uncorrelated strategies that have undergone rigorous robustness testing.

Available in these collaterals

High Sharpe High Vol

A pure short-term focused portfolio combining breakout momentum and mean reversion strategies on both the long and short side. Designed to capture short-term profits, even in non-trending markets.

High Sharpe Low Vol

Same strategy logic as the High Vol variant, but with reduced net exposure and strategy weights. Built for clients seeking consistent returns with lower volatility.

Charts show compounded returns using USD collateral

View Reports

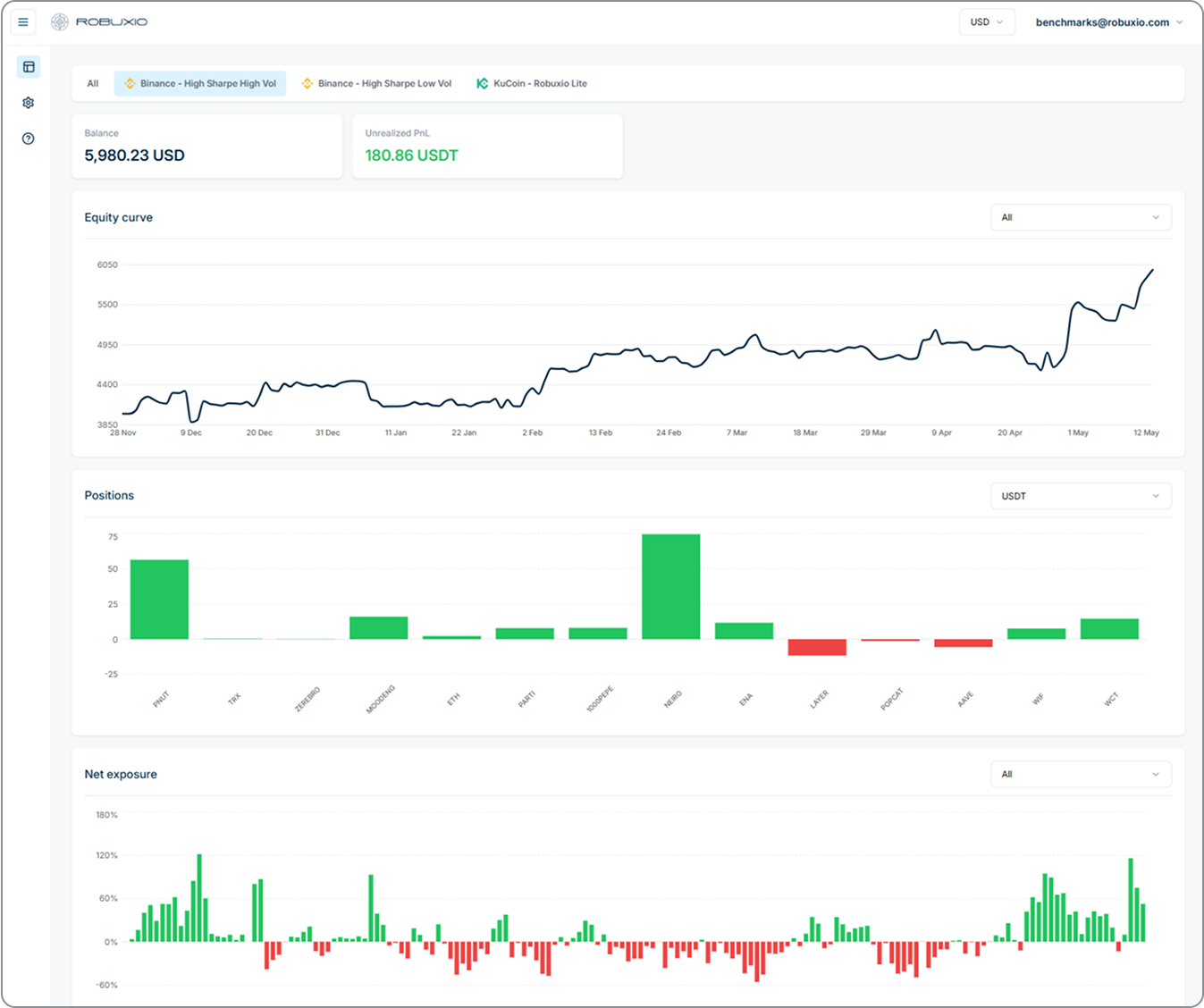

*Dashboard shown only available with Direct Exchange Access. Prime Brokerage clients can track performance via the MatrixPort app.

Step 4: Enjoy the Ride

Real-Time Execution. Full Transparency.

Built For Everyone

Zero Experience Needed

No prior trading experience or crypto knowledge is required. Let our robust data-backed portfolios take away the guesswork.

Hands‑Off 24/7 Automation

Everything is automated. Our trading engine handles every part of the trading process for you.

Your Funds, Your Wallet

Assets stay in your crypto exchange wallet. You link to our trading engine via trade-only API and can revoke access anytime.

Start Small, Scale Anytime

Launch with as little capital as you are comfortable with or add capital to your exchange wallet whenever you are ready to scale.

Ready to Automate Your Crypto Portfolio?

Let Robuxio handle execution, strategy, and risk, while you stay in control.

Frequently Asked Questions

Do I need trading experience?

No. Robuxio is a fully automated trading platform. You don't need to understand charts, signals, or indicators to use it effectively. That said, we provide full transparency and clear explanations of the strategies being used in your selected portfolio, so you always know what's happening.